Blog + News

Tax Announcements in the November 30, 2020 Federal Government Fall Economic Statement

On November 30, 2020, the Canadian Federal Government released the Fall Economic Statement 2020 (the “Economic Statement”). The Economic Statement is full of jaw-dropping stimulus spending, but not many measures to increase tax revenues. Prior to November 30, 2020 there were some concerns the Government might announce tax rate increases for the top personal tax brackets and increase the capital gains inclusion rate. Some had also speculated that the Government might also introduce a wealth tax. The Economic Statement did not contain any of those measures.

While the absence (for now) of major tax increases is good news for our clients, it does create a scary picture of Canada’s fiscal health going forward. The new taxing measures that the Economic Statement announces will bring in revenues that are nowhere close to the Covid spending by the Government this year. For example, the new sales tax measures will bring in an estimated total of $3 billion over the next five years. With respect to the Canada Emergency Response Benefit (CERB) alone, the Government has handed out $81.64 billion as of October 4, 2020.[1] Overall, the Economic Statement projects a $381.6 billion deficit for the year 2020-2021. While we are not economists, this is a staggering number for a country the size of Canada. This gap will eventually need to be dealt with – the trillion-dollar question is whether this will be addressed through substantial tax increases in the near future or some other approaches. Answers to that difficult issue are likely best left to economists to answer. In the meantime, please read on for our review of the tax measures contained in the Economic Statement.

Additional Canada Child Benefit (CCB) for 2021

For the 2020-21 benefit year (July 1, 2020 to June 30, 2021), the CCB currently provides a maximum benefit of $6,765 per child under the age of six and $5,708 per child aged six through 17. The maximum benefit is available to families with less than $31,711 in adjusted net income in 2019, and the benefit phases out with higher income amounts.

The Government proposes to provide additional CCB for families in 2021. The additional amounts will be four quarterly payments of:

- $300 per child under the age of six to families entitled to the CCB with family net income equal to or less than $120,000, and

- $150 per child under the age of six to families entitled to the CCB with family net income above $120,000.

These amounts are only available to individuals entitled to the normal CCB. If adjusted family net income is too high to receive the normal CCB, the family also will not receive this additional payment. The additional CCB will be treated the same as normal CCB, e.g., it will not be taxable and will not be included for purpose of income-tested benefit programs.

This should provide some assistance to families with children, while leveraging an existing program to keep administration simple. However, this measure is estimated to cost the Government $2.355 Billion over the next two fiscal years. That is a staggering number.

Limiting Beneficial Tax Treatment of Employee Stock Options

In the 2015 election campaign, the Liberal Party campaigned on changing Canada’s current employee stock option regime but quickly backed away from any changes after getting elected. Currently, employee stock options, as long as they were not issued in-the-money, qualify for a stock option deduction equal to one-half of the stock option benefit. This treatment is logical because the stock option benefit arises from increases in the value of the stock after the option is granted, and therefore is similar in nature to a capital gain.

As stated in the Economic Statement, it has been observed that the recipients of stock option benefits are disproportionately “a small number of high-income individuals employed by large, established corporations”. This is not surprising, as we know Canadian banks and many major Canadian public companies use stock options heavily in remunerating their executives. While this reduces the executives’ personal tax burden and reduce immediate cashflow impact for the employers, most school of thought in business theory believes that this also helps align executives’ incentives with that of the shareholders.

In the 2019 Federal Budget, the Liberal Government tried again to modify the stock option rules and later introduced legislation to fulfill their objectives. However, their main objective was to limit the proposed changes for individuals employed by “large, long-established, mature firms”. The policy justification for the change was probably that stock value increases of these types of organization were considered so secure and predictable that capital-gain-like treatment for stock options issued by these organizations was no longer appropriate. However, it is fairly clear what really drove this was due to negative public perception of business executives of large organizations earning large remuneration packages, and the perceived unfairness of them receiving a beneficial tax treatment. That attempt to modify the stock option rules was met with much opposition, primarily due to the uncertainty of defining what is a “large, long-established mature” firm, and eventually, those legislative proposals were delayed. We wrote about the 2019 proposals and provided a bit of a history lesson on the taxation of stock options here.

The Economic Statement is now the revised “second try”. Here is a summary of the changes being proposed.

What type of organization is impacted?

The Government, after listening to much feedback, is now including a bright line test to define which employers will be caught by these new rules. The proposed changes will apply to any corporate or mutual fund trust employer unless:

- It is a Canadian-controlled private corporation (CCPC); or

- It is not a CCPC, but it, or the consolidated group that it is part of, has annual gross revenues of less than $500 million.

In other words, employees of CCPCs and organizations with less than $500 million annual revenue are not impacted by these new rules.

Treatment to employees receiving stock options from affected organizations

For an employee receiving stock options from an employer impacted by these rules, a $200,000 annual vesting limit (based on the value of an option’s underlying shares at the date of grant) is imposed for options that can qualify for the 50% employee stock option deduction. The amount of the benefit arising from the exercise of stock options over the $200,000 vesting limit will not be entitled to the stock option deduction. Those benefits on options above the annual vesting limit will be fully included in income like regular employment income. An employee who has two or more employers will have a separate $200,000 limit for each employer (provided the employers deal at arm’s length with each other).

Treatment to employers

For employee stock options in excess of the $200,000 limit, the employer will be entitled to an income tax deduction in respect of the stock option benefit included in the employee’s income. Employers may also elect to have this tax treatment apply for stock options below the $200,000 threshold (and correspondingly, the employee will not get stock option deduction). It should be noted that employers who are not subject to these proposed changes (i.e., CCPS and organizations with less than $500M annual gross revenue) will not be able to make this election. In other words, nothing from these rules should impact employees of CCPCs and organizations with less than $500M annual gross revenue.

When will the rules be effective?

Unlike typical tax announcements that often takes effect the day of the announcement, this proposal will take effect seven months into the future. If enacted, the new rules will apply to employee stock options granted after June 2021. The existing rules would continue to apply to options granted before July 2021, including qualifying options granted after June 2021 that replace options granted before July 2021.

By giving this leeway, Finance is intentionally providing a window of opportunity to affected employers to grant large number of options to employees before July 2021 so as to have as many options grandfathered under preferential old rules as possible subject to any other law that might prevent this from happening.

Will this proposed change bring in much tax revenues?

No. By allowing an employee stock option deduction, Canada gives up the right to tax half of the stock option benefit. Even assuming top marginal tax bracket, the tax given up is approximately 25 cents on the dollar depending on the province of residence of the individual. Under the proposed rules, the impacted employee loses this beneficial treatment, but the corporation now gets to deduct the stock option benefit at a corporate tax rate of approximately 25% depending on province of residence of the corporation. This gives at best a net zero result in terms of tax intake to the Government.

Curiously, in the Economic Statement, the Government stated that, the proposed stock option measures “once fully in effect, are expected to generate about $200 million in federal tax revenues each year”. This statement seems irreconcilable since the same document later provides a fiscal costing table where the Government itself estimates a net $0 intake from this proposed measure for years 2021 to 2025 and a paltry $55 million revenue intake in year 2026 from this proposed measure.

Extending Canada Emergency Wage Subsidy (CEWS) and Canada Emergency Rent Subsidy (CERS)

No changes to the underlying mechanism of CEWS and CERS were announced. We have previously written about the latest CEWS legislation here and the CERS here. The rates and thresholds for the CEWS and CERS program were previously provided up to December 2020, so the Economic Statement provides new rates and thresholds for up to March 2021.

New Claim Periods 11 to 13

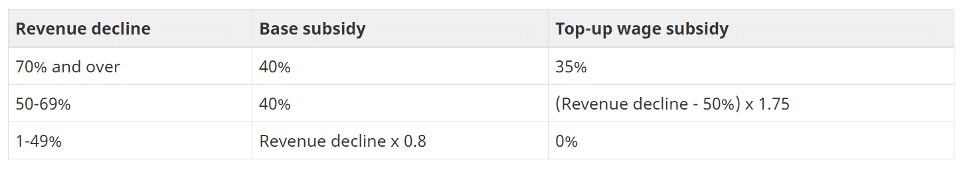

Proposed CEWS for active employees – Periods 11 to 13

The proposed rates for Claim Periods 11 to 13 are below. Most notably, the top-up wage subsidy is increased from a maximum of 25% to 35%, with a corresponding change to the top-up calculation formula. It should also be noted that after Period 10, the top-up wage subsidy will no longer be based on the 3-month revenue decline and will only be based on the monthly revenue decline percentage.

Proposed CEWS for furloughed employees – Periods 11 to 13

The weekly wage subsidy for a furloughed employee from December 20, 2020 to March 13, 2021 is proposed to be the lesser of:

- the amount of eligible remuneration paid in respect of the week; and

- the greater of:

- $500, and

- 55% of pre-crisis remuneration for the employee, up to $595.

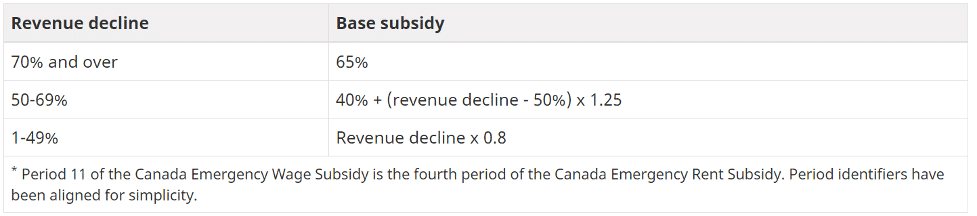

Proposed CERS – Periods 11 to 13

The CERS rates and amounts for Periods 11 to Period 13 essentially remain the same as it is now:

The Government also proposes to extend, until March 13, 2021, the current 25-per-cent rate for the CERS top-up for qualifying properties subject to a “public health restriction” (also known as Lockdown Support).

National Vacant Home Tax May Be Coming

The Government announced its intention to implement a national, tax-based measure targeting the “unproductive use” of domestic housing that is owned by non-resident, non-Canadians. No details are provided on this. We are guessing it will likely be similar to the B.C. speculation and vacancy tax but imposed nation-wide. Hopefully, the Government will take into account regional differences in real estate market conditions and impose this nationwide tax only on cities with truly overheated real estate markets. Some locations (like Calgary, where the authors live) need more foreign investors, not less.

Brush Up Your Resume, since CRA Will Be Hiring!

The Government proposes to inject an additional $606 million over 5 years to hire additional offshore-focused auditors to focus on individuals who avoid taxes by hiding income and assets offshore, enhance the audit function targeting higher-risk tax filings (including those of high-net worth individuals), and strengthen its ability to fight tax crimes such as money laundering and terrorist financing.

Of particular interest to us is the CRA’s increasing focus on high-net worth individuals. Over the last decade, we have seen a trend of CRA expanding its audit resources targeting successful private businesses and the families who own them – this clearly will continue. Taxpayers within this demographic should plan their affairs with the expectation that their transactions will eventually be subject to scrutiny by the CRA.

“Modernizing” the GAAR?

The Economic Statement announces that the Government will launch consultations on how Canada’s anti-avoidance rules, in particular the General Anti-Avoidance Rule (GAAR) can be modernized, with the goal that these rules be “sufficiently robust for tax authorities and courts to address … sophisticated and aggressive tax planning”. As it is currently drafted, the GAAR is already very broad and in our view, has been properly applied by the courts to deal with abusive tax planning. It is unclear to us what particular aspect the Government thinks the GAAR is lacking. Perhaps it is a reaction to the Federal Court of Appeal’s recent decision in The Queen v. Alta Energy Luxembourg where the Federal Court of Appeal found that “treaty shopping” arrangements are not inherently abusive for Canadian tax purposes.

Excuse us for our pessimism, but we think this is most likely either going to end up as an expensive make work project, or we get a new GAAR that will be too broad and too burdensome for ordinary commercial transactions.

Simplifying the Home Office Expense Deduction

The Government announced that the CRA will allow employees working from home in 2020 due to COVID-19 with modest expenses to claim up to $400, based on the amount of time working from home, without the need to track detailed expenses, and will generally not request that people provide a signed form from their employers. Further details will be provided by the Government at a later date.

Proposed Sales Tax Measures

- Temporary GST/HST zero-rating of certain face masks and face shields. This will be effective for items made after December 6, 2020;

- Various new GST/HST measures to ensure that non-resident vendors supplying digital products and services (including traditional services) to consumers in Canada, or supplying goods through fulfillment warehouses in Canada, will be subject to GST/HST;

- New GST/HST measure to ensure supplies of short-term accommodations in Canada facilitated through a digital platform will be subject to GST/HST (e.g., AirBnb rental); and

- The government is proposing to implement a tax on corporations providing digital services in Canada, with effect from January 1, 2022, which would apply until such time as an acceptable common approach – currently being developed by the OECD – comes into effect.

That’s all. Hopefully, this will be the last round of changes to the Income Tax Act this year. The authors – and we think taxpayers in general – are ready for a break from non-stop tax change announcements.

[1] https://www.canada.ca/en/services/benefits/ei/claims-report.html provides statistics on CERB and is regularly updated by the Government of Canada.

Related Blogs

Have you ever wondered how much your US citizenship is costing you? Why renouncing could save you hundreds of thousands and open new doors for financial opportunities.

As US expats prepare for another expensive and stressful tax filing season, we’ve compiled a list of...

Looking to make 2024 your last filing year for US taxes? Here’s what you need to do.

In a recent survey, one in five US expats (20%) is considering or planning to renounce their...

Travelling to the US? If you’re a US expat who doesn’t renounce properly, your trip may never get off the ground.

Air travel can be stressful. Rising airfares and hotel costs, flight cancellations, pilot strikes, long security wait...